What is tax free?

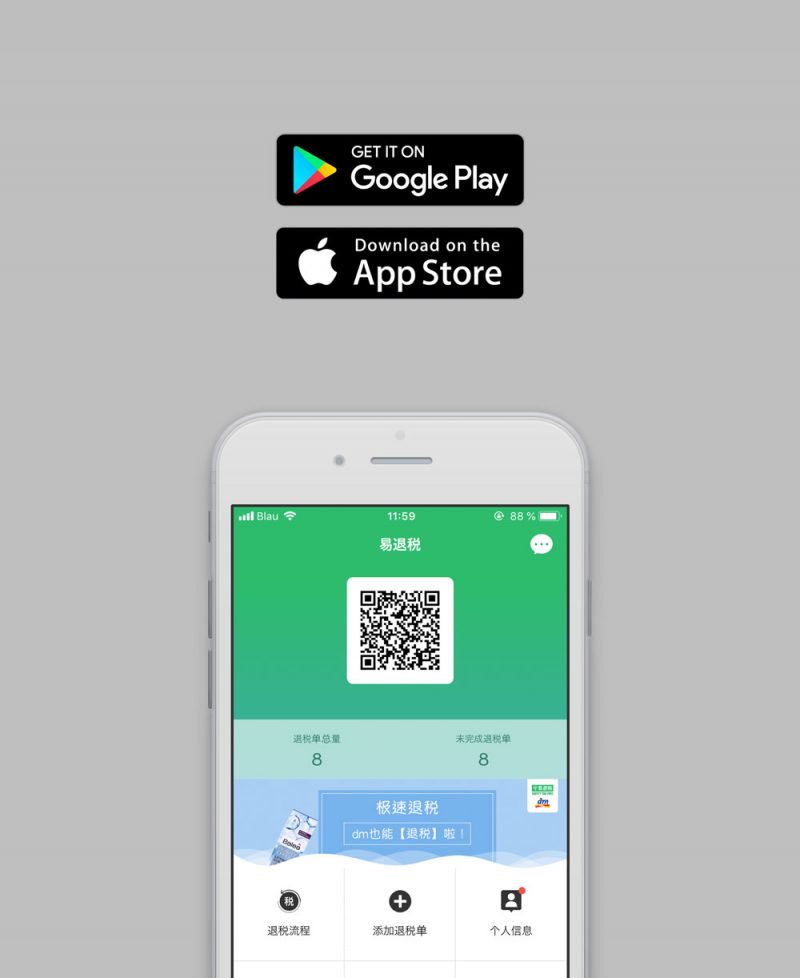

Did you know that international travellers can save up to 25%* when shopping in Europe? Global shoppers have the right to claim the VAT from their purchases when shopping in any EU member state during their trips, however, this process has always been time-consuming and involved a lot of bureaucracy for both shoppers and retailers. Safety Tax Free has drastically reduced waiting times and paperwork by digitalising the tax free process and has developed an easy-to-use solution that allows you to take control of your refund directly from your smartphone.